Jurrien Timmer, head of global macro at Fidelity, said bitcoin is undervalued and oversold.

Jurrien Timmer, who has 126,000 Twitter followers, explained that although Bitcoin has fallen back to 2020 levels, its “price-to-network ratio” has fallen back to 2013 and 2017 levels. This may represent an undervaluation.

In the traditional stock market, investors use price-to-earnings (P/E) ratios to measure whether a stock price is low or expensive, and overvalued or undervalued. If the ratio is high, it means that the value of the asset is overvalued. On the contrary, if the ratio is low, it means the value is undervalued.

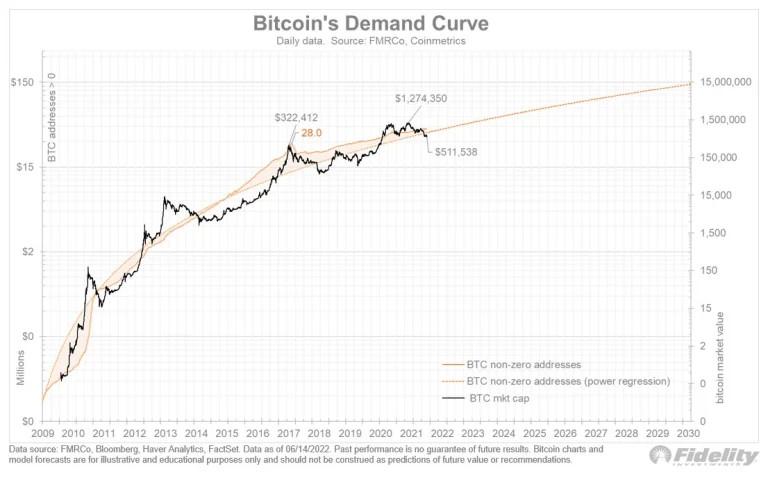

Jurrien Timmer posted a graph of Bitcoin’s demand curve, which shows the overlap between Bitcoin’s non-zero addresses (at least a little bit of Bitcoin) and its market cap, noting that Bitcoin’s price is now below the network curve.

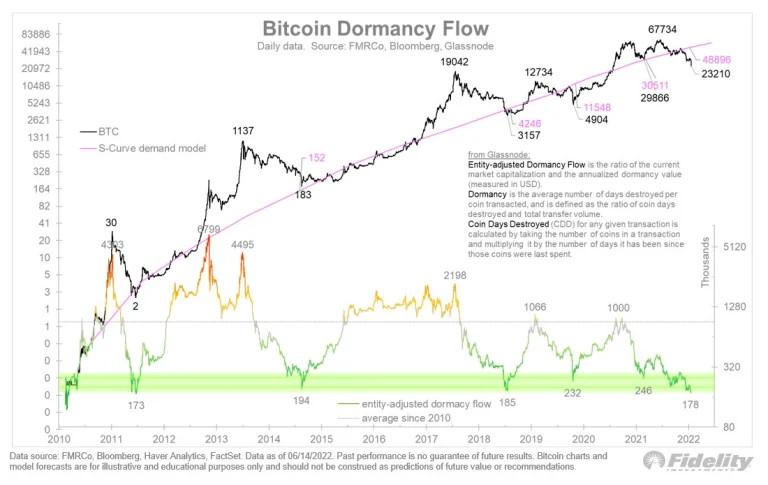

The macro analyst also posted another chart using Glassnode’s DormancyFlow indicator, which he noted shows how technically oversold Bitcoin is.

Entity-adjusted dormant traffic is a popular metric for judging Bitcoin’s value by comparing price and spending behavior. This indicator shows traders the ratio of the current cryptocurrency capitalization to its total dollar value.

According to Glassnode, low dormant traffic may indicate increased belief among long-term holders, meaning long-term Bitcoin holders are taking over from anxious short-term holder’s sellers.

The analyst said: Glassnode’s dormant traffic metrics are now at levels not seen since 2011.

Morgan Creek Digital co-founder Anthony Pompliano shared a similar sentiment on Monday, explaining that Bitcoin’s value and price are divergent, with weaker players selling to stronger players.

Anthony Pompliano said: “What we are watching is a shift from short-term holdings of weak players to long-term oriented strong players.

Bitcoin’s fear and greed index has fallen to 7 on the 15th, which means it has fallen into the extreme fear zone, which is also the lowest level since the third quarter of 2019. In the past, indexes fell into low gear, often representing a buying opportunity.

Both Fidelity Investments and Jurrien Timmer remain bullish on Bitcoin. Fidelity Investments has worked to launch a Bitcoin Retirement Investment Plan that will allow people in the U.S. with 401(k) savings accounts to directly invest in Bitcoin. Timmer predicts that Bitcoin will soon see a recovery in the price of the currency.

The same is true for the price of mining machines. The current price is already in the low-price range. If you invest now, you will get more benefits in the future.

Post time: Aug-03-2022