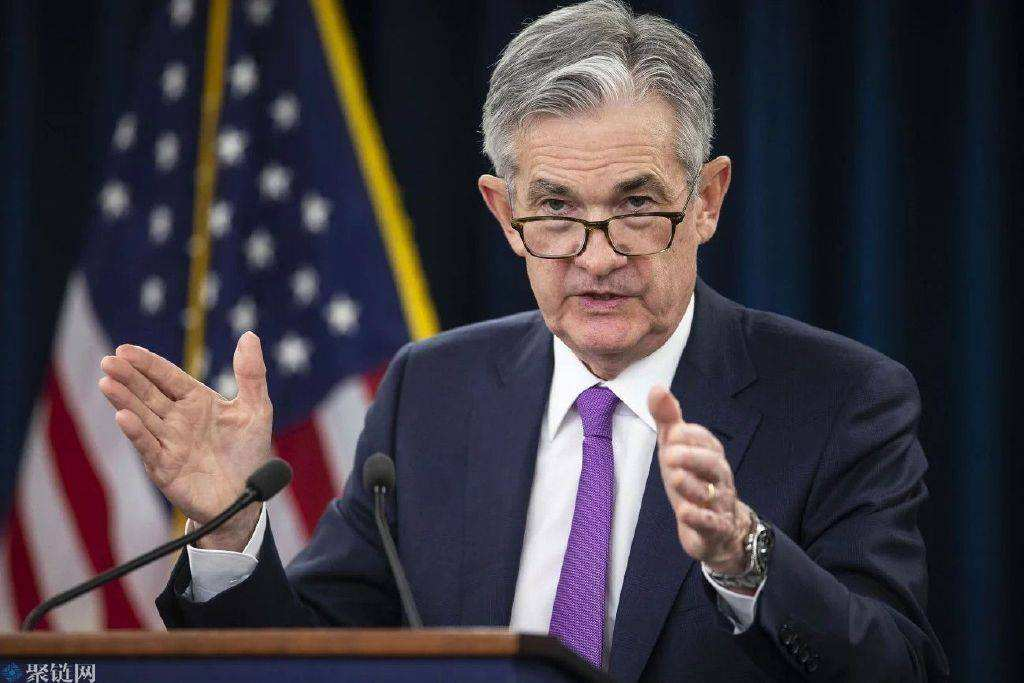

US Federal Reserve (Fed) Chairman Jerome Powell (Jerome Powell) attended a hearing held by the Senate Finance Committee yesterday (22) evening to testify on the semi-annual monetary policy report. “Bloomberg” reported that Powell showed at the meeting the Fed’s determination to raise interest rates enough to see inflation noticeably cool, and he said in his opening remarks: Fed officials expect continued interest rate hikes will be appropriate to ease the 40 The hottest price pressure in years.

“Inflation has clearly risen unexpectedly over the past year, and there are likely to be more surprises to come. So we need to be flexible with incoming data and the changing outlook. The pace of future rate hikes will depend on As to whether (and how quickly) inflation starts to fall, our mission cannot fail and must return inflation to 2%. Any rate hikes are not ruled out if it proves necessary. (100BP included)”

The Federal Reserve (Fed) announced on the 16th that it would raise interest rates by 3 yards at a time, and the benchmark interest rate rose to 1.5% to 1.75%, the largest increase since 1994. After the meeting, it said that the next meeting is most likely to increase by 50 or 75%. basis point. But there was no direct mention of the scale of future rate hikes at Wednesday’s hearing.

Soft landing is very challenging, recession is a possibility

Powell’s pledge sparked strong concerns that the move could tip the economy into recession. At the meeting yesterday, he reiterated his view that the U.S. economy is very strong and can handle monetary tightening well.

He explained that the Fed is not trying to provoke, nor does it think we need to provoke a recession. While he doesn’t think the chances of a recession are particularly high right now, he acknowledges that there is definitely a chance, noting that recent events have made it harder for the Fed to lower inflation while maintaining a strong labor market.

“A soft landing is our goal and it’s going to be very challenging. The events of the past few months have made this even more challenging, think about the war and commodity prices and further issues with supply chains.”

According to “Reuters”, the Fed is dovish, and Chicago Federal Reserve Bank President Charles Evans (Charles Evans) said in a speech on the same day that he is in line with the Fed’s core view of continuing to raise interest rates rapidly to combat high inflation. And pointed out that there are many downside risks.

“If the economic environment changes, we must remain vigilant and be prepared to adjust our policy stance,” he said. “Repairs on the supply chain side may be slower than expected, or the Russian-Ukrainian war and China’s COVID-19 lockdown could bring prices down,” he said. More pressure. I expect further rate hikes will be necessary in the coming months to bring inflation back to the 2% average inflation target. Most Fed rate-setting committee members believe rates need to rise to at least 3.25 by the end of the year %-3.5% range, rising to 3.8% next year, my view is roughly the same.”

He hinted to reporters after the meeting that unless inflation data improves, he may support another sharp three-yard rate hike in July, saying the Fed’s top priority is to ease price pressures.

In addition, in response to the dramatic volatility in the overall cryptocurrency market in recent days, Powell told Congress that Fed officials are closely watching the cryptocurrency market, while adding that the Fed has not really seen a major macroeconomic impact so far, but stressed that The cryptocurrency space needs better regulations.

“But I think this very innovative new area does need a better regulatory framework. Wherever the same activity occurs, there should be the same regulation, which is not the case now because many digital financial products are in some ways Very similar to products that exist in the banking system, or capital markets, but they are regulated differently. So we need to do that.”

Powell pointed to congressional officials that regulatory ambiguity is one of the biggest challenges facing the cryptocurrency industry right now. The U.S. Securities and Exchange Commission (SEC) has jurisdiction over securities, and the Commodity Futures Trading Commission (SEC) has jurisdiction over commodities. “Who really has power over this? The Fed should have a say in how Fed-regulated banks handle crypto assets on their balance sheets.

Regarding the recently heated issue of stablecoin regulation, Powell compared stablecoins to money market funds, and he believes that stablecoins still do not have a proper regulatory plan. But he also applauded the wise move of many members of Congress to propose a new framework to regulate stablecoins and digital assets.

In addition, according to Coindesk, the SEC recently recommended in its accounting instructions for listed companies that custodian companies that hold customers’ digital assets need to treat these assets as belonging to the company’s own balance sheet. Powell also revealed at the meeting yesterday that the Fed is evaluating the SEC’s position on digital asset custody.

Increased government regulation is also a good thing for cryptocurrencies, allowing cryptocurrencies to enter a more compliant and healthier environment. It can better protect the rights and interests of upstream and downstream industries of cryptocurrencies such as miners and virtual currency investors.

Post time: Aug-21-2022