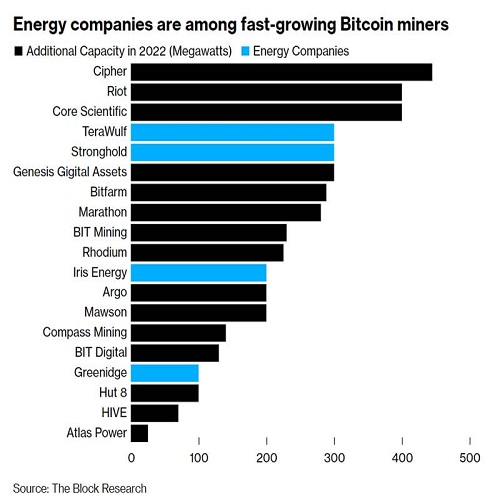

According to Bloomberg, energy companies such as Beowulf Mining, CleanSpark, Stronghold Digital Mining and IrisEnergy are becoming the main forces in the cryptocurrency mining industry. As the profit space of bitcoin mining industry is continuously compressed, energy companies that do not need to worry about power supply have gained a comparative advantage over their competitors.

Previously, the mining profit margin of energy enterprises was as high as 90%. Analysts said that since the price of bitcoin has been 40% lower than the historical high in November last year, coupled with the soaring energy prices caused by the conflict between Russia and Ukraine, the profit margin of bitcoin mining has dropped from 90% to about 70%. With the halving of bitcoin mining reward in less than three years, it is expected that the profit margin will be further under pressure.

Beowulf Mining, an energy company that built a data center for Marathon Digital in 2020, is one of the first energy groups to find bitcoin mining profitable. According to the regulatory documents of Tera Wulf, a cryptocurrency subsidiary of Beowulf mining, the company’s mining capacity is expected to reach 800 MW by 2025, accounting for 10% of the total computing power of the current bitcoin network.

Gregory beard, CEO of Stronghold, another energy company, pointed out that although mining enterprises can make a considerable profit of 5 cents per kilowatt, energy companies with direct energy and power assets can often enjoy lower mining costs.

Gregory Beard pointed out that if you buy energy from manufacturers and then pay third-party operators to manage the data center, your profit margin will be lower than those companies that own energy.

Energy companies are more willing to sell bitcoin

Traditional bitcoin mining companies usually pay hosting sites to set up their own data centers and host, operate and maintain their own mining machines. However, since China’s comprehensive mining ban has brought billions of dollars of unexpected wealth to American mining companies, the cost of this type of service has also continued to rise.

Although energy companies are aggressively entering the mining industry, in the United States, mining companies that invested in bitcoin mining earlier, such as Marathon Digital and Riot Blockchain, still dominate in terms of computing power. However, energy companies transformed into bitcoin mining companies have another advantage over traditional mining companies, that is, they are more willing to sell their excavated bitcoins rather than hold them for a long time like some cryptocurrency enthusiasts.

With the recent decline in bitcoin prices, traditional mining companies such as Marathon Digital have been looking to support their balance sheets and turn to bond and equity capital markets to raise funds. In contrast, Matthew Schultz, executive chairman of CleanSpark, revealed that CleanSpark had never sold an equity stake since November last year because the company had sold bitcoin to support its operations.

Matthew Schultz said: what we sell is not part of the company, but a small part of bitcoin we dig out. According to the current price, digging out a bitcoin in our company’s own facilities costs about $4500, which is a 90% profit margin. I can sell bitcoin and use bitcoin to pay for my facilities, operations, manpower and costs without diluting my equity.

Post time: Apr-01-2022