On the eve of the FOMC meeting, the cryptocurrency market, which had been rising a few days ago, turned volatile. After rising to $21,085 on the 29th, Bitcoin (BTC) dropped to $20,237 last night, and was reported at $20,568 as of the deadline, nearly 24 The hourly increase was 0.52%; ether (ETH) was at $1,580, up 1.56% in the past 24 hours.

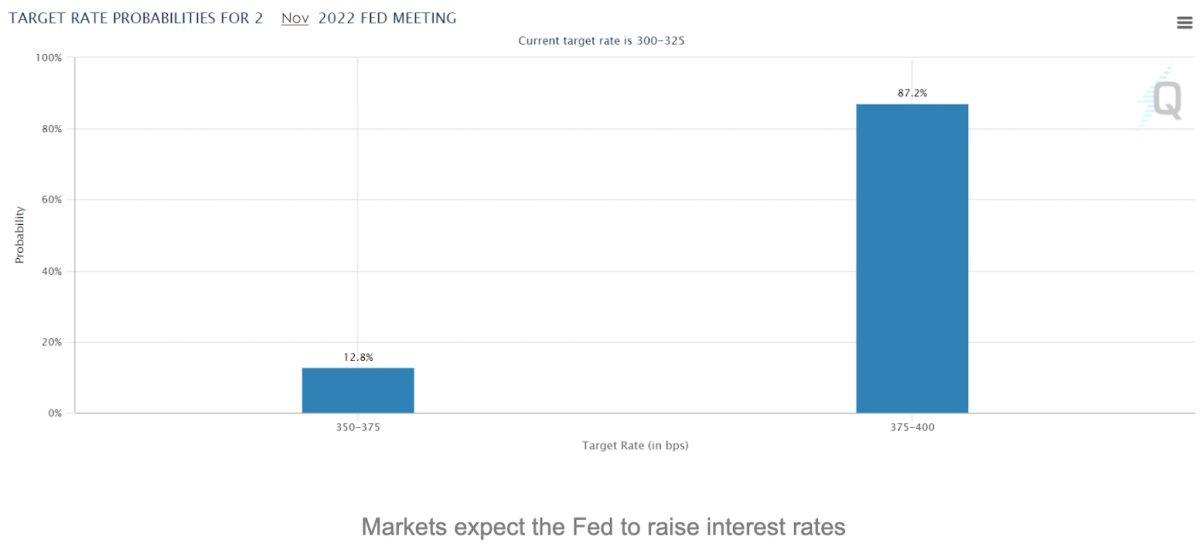

The Fed will announce its interest rate decision at 2:00 a.m. Beijing time on the 3rd. According to data from the Fed Watch Tool of the Chicago Mercantile Exchange (CME), the market currently expects that the Fed will decide to raise interest rates by 3 yards to 3.75% this week. There is an 87.2% chance of a 4.00% rate hike and a 12.8% chance of a 2-yard rate hike to 3.50% to 3.75%.

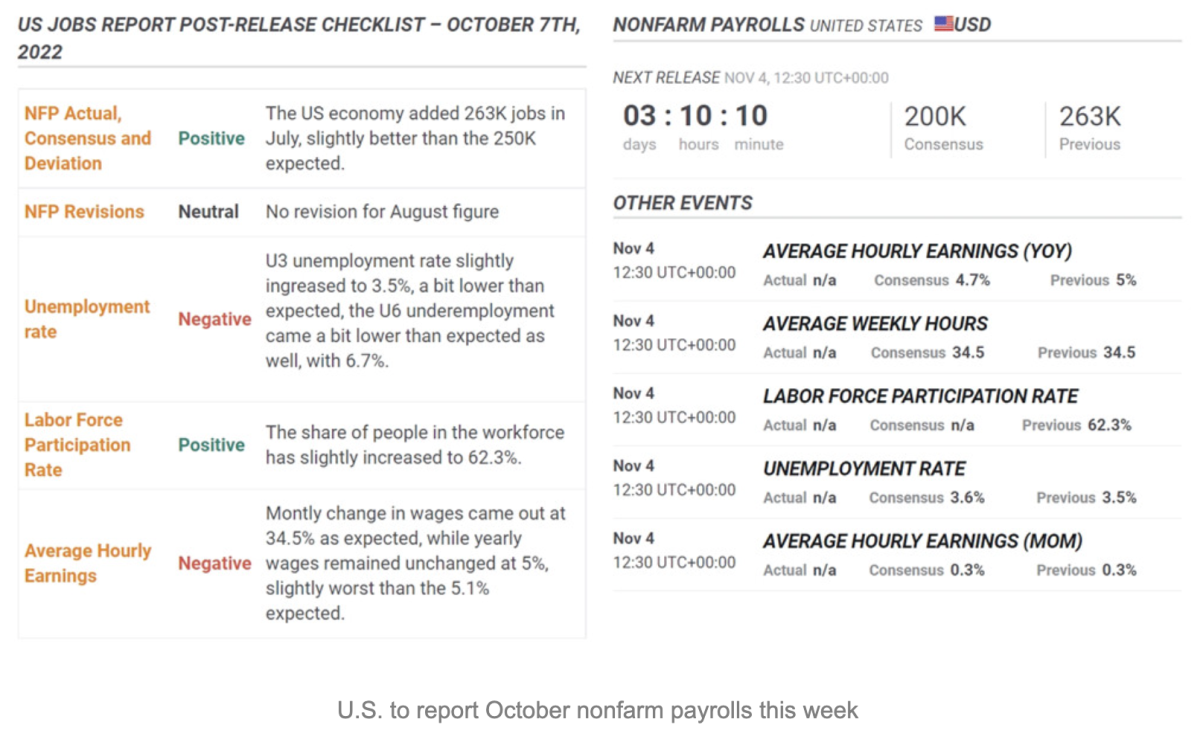

Another data worthy of attention is that the United States will announce the number of non-farm payrolls for October at 20:30 Beijing time on the 4th. According to FXStreet data, the market currently estimates that the number of non-farm payrolls will increase by 200,000, which is lower than the previous The unemployment rate is expected to rise to 3.6% from 3.5%.

U.S. stocks may rise sharply if interest rate hikes 2 yards

At the same time, according to “Bloomberg”, JPMorgan’s trading department predicted that if the Fed decides to raise interest rates only 2 yards this week, Federal Reserve Chairman Jerome Powell (Jerome Powell) expressed his willingness to tolerate at a post-meeting news conference. With high inflation and a tight labor market, the S&P 500 could surge at least 10% in a single day.

The JPMorgan Chase team, including analyst Andrew Tyler, bluntly said in a client note on Monday that such a scenario would be “the least likely” but would be the “most bullish” outcome for stock investors. In the previous six Fed decision days, the S&P 500 rose four times and fell two times.

JPMorgan expects the Fed will still raise rates by another 3 yards this week, in line with the median forecast of economists polled by Bloomberg, and Andrew Tyler’s team sees a low chance of other scenarios.

Regarding the S&P 500 forecast, the report wrote: The results are skewed to the upside, as we believe that the market has a good reason to retest the lows last week due to the disappointing earnings of large technology stocks, but continues to rise. The point of the conversation is, trying to identify who are the incremental sellers, and we believe the risk/reward is skewed to the upside.

Here are the JPMorgan Chase team’s predictions for the likely direction of the S&P 500 on Fed decision day:

● 2-yard rate hike and post-dovish press conference: S&P 500 up 10%-12%

● 2-yard rate hike and post-hawk press conference: S&P 500 up 4% to 5%

● 3-yard rate hike and post-dovish press conference (second most likely): S&P 500 up 2.5%-3%

● 3-yard rate hike and post-hawkish press conference (most likely): S&P 500 down 1% to gain 0.5%

● 4-yard rate hike and post-dovish press conference: S&P 500 down 4% to 5%

● 4-yard rate hike and post-hawk press conference: S&P 500 down 6% to 8%

Post time: Nov-11-2022